Jet Airways‘ lenders have announced their intention to begin bankruptcy proceedings following failed attempts to rescue the troubled airline. This is the last nail in the coffin for what used to be one of India’s largest private airlines. As SpiceJet CEO’s was recently saying, this is a “wake-up call” for the aviation industry.

Since April, Jet Airways has suspended all flights and grounded its entire fleet. Many passengers were stranded around the world. Pilots, flight attendants and engineers have not been paid for months.

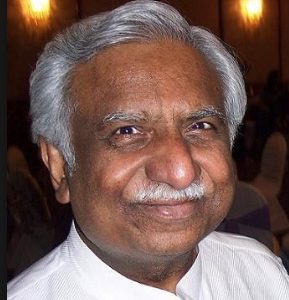

Jet Airways, India’s former flagship

Jet Airways was founded in 1993. It rose up as Air India went down. At its peak, Jet Airways was flying to 600 domestic destinations and 380 international destinations. It had more than 110 aircraft in its fleet and employed more than 16,000 people.

But a flawed business model that failed to adapt to a competitive landscape coupled with rising operating costs, forced India’s leading commercial airline to cease all operations, leaving behind a $4 billion slate.

Is Jet Airways’s Bankruptcy really the end?

As the bankruptcy proceedings starts, it is possible for a potential buyer to revive the company. Yet, with a debt exceeding $4 billion, and a business model that would require a complete operational overhaul, Jet Airways seems unlikely to find any suitors.

Jet Airways shares slump more than 17% following this new development.

John is a passionate traveler who has traveled to over 46 countries on more than 30 different airlines. He loves surfing, booking hotels and flights using his frequent flyers points, and exploring new cultures. John lives in London.