Just one day ahead of the National Company Law Tribunal passing an order on insolvency pleas filed by State Bank of India, Jet Airways share prices rose 150%. With mounting debts, Jet Airways shares have dropped steadily for some time now, falling 78% over the last 13 sessions. This news comes after a 52 week low for the airline’s shares.

Lenders choose bankruptcy court option

Headed by State Bank of India, Jet Airways lenders have opted now to disregard the option of an outright sale, despite encouragement from the government to work with potential bidders, and have instead gone to the bankruptcy court in an attempt to recover the debts owed by the failing airline. Apparently, despite some interest, there were no bids received that the lenders were satisfied with.

The fall of Jet Airways

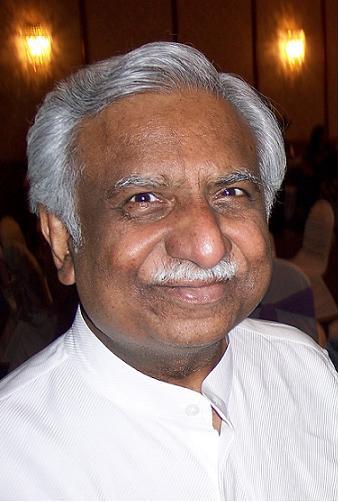

Once the largest private sector airline in the world, Jet Airways has seen some success over the 25 years since it began, the brain-child of entrepreneur Naresh Goyal. However, more recently, financial problems have grown and the airline could not find further funding. On 17th April this year, the final planes were grounded, there was literally no more cash to pay for fuel or leasing charges and staff wages have not been paid since March.

Further bad press has accumulated, with Goyal being questioned regarding tax evasion due to excessive payments to sales agents in Dubai. These allegations did nothing to help the airline’s reputation nor its share prices.

Things were looking up for a while as both Etihad Airways and Hinduja Group showed an interest in investing in Jet Airways, but neither actually came to fruition and so share prices fell again. Attempts to sell the airline over the last several months have all failed.

A series of resignations

Several Jet Airways top executives have now resigned, including the company’s founder Naresh Goyal and his wife Anita Goyal. Control of the airline has now been passed to the lenders, a consortium of 26 bankers led by State Bank of India.

Bombay Stock Exchange seek clarification

Such an unusual rise in share price did not go unnoticed by the Bombay Stock Exchange which has contacted the airline to seek clarification regarding the circumstances of the rise. A reply has not yet been received.

A positive sign?

This large and rapid share price increase would appear to bode well for Jet Airways, it’s a sure sign that the market is at least somewhat hopeful of a good outcome at the upcoming National Company Law Tribunal where it will be decided whether or not Jet Airways is to go under the bankruptcy process.

John is a passionate traveler who has traveled to over 46 countries on more than 30 different airlines. He loves surfing, booking hotels and flights using his frequent flyers points, and exploring new cultures. John lives in London.